Recent Articles

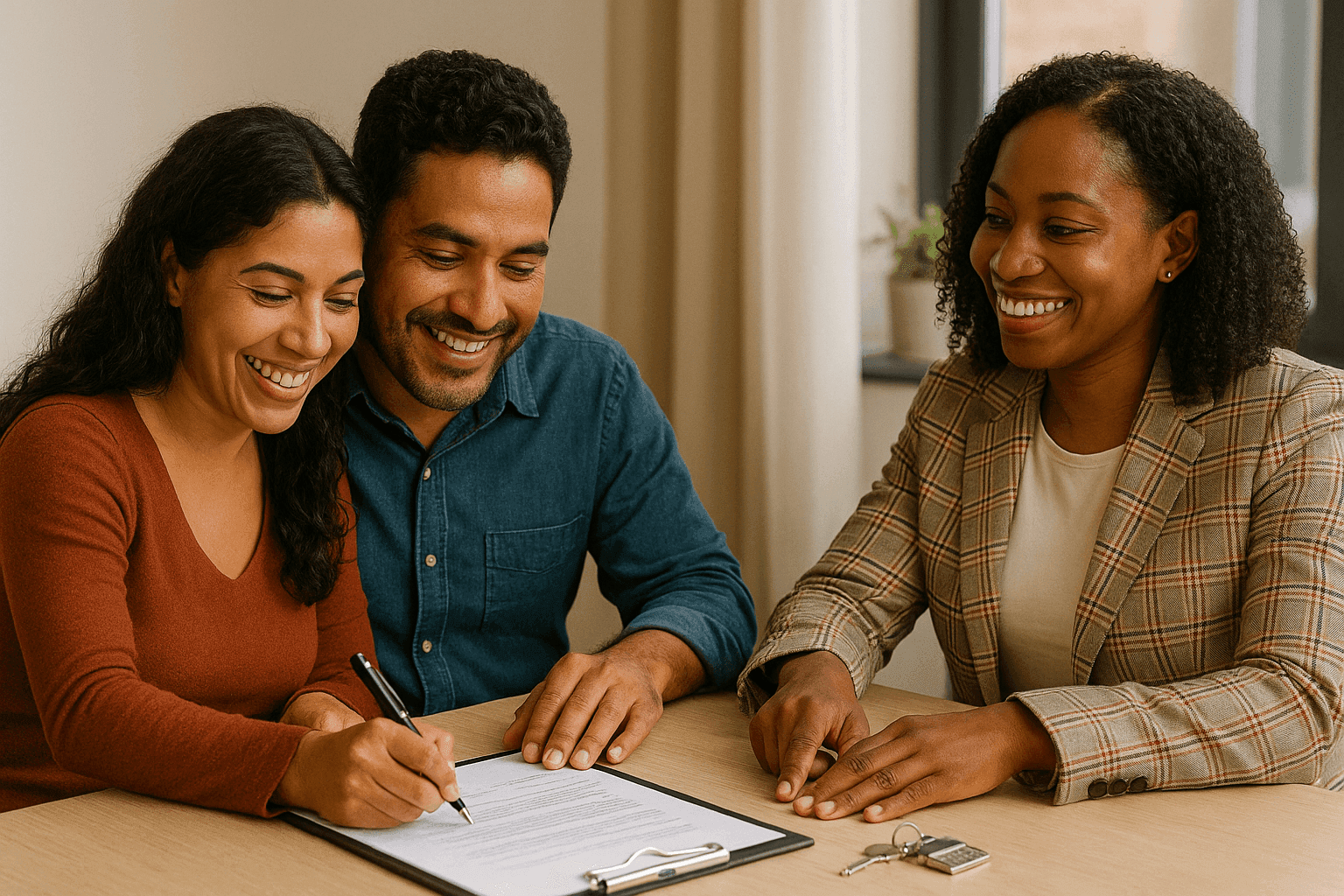

Yes, You Can Buy a Home Without a Social: A Guide for ITIN Buyers in Middle Tennessee

If you’ve been told you can’t buy a home because you don’t have a Social Security number, let me stop you right there. You’re working. You’re paying taxes. You’re building a future for your family. And yes—you absolutely CAN buy a home using your ITIN (Individual Taxpayer Identification Number). My name is Frankie B, and I help families in Smyrna, Murfreesboro, Nashville and beyond become homeowners every single day. Let’s walk through what you need to know—in plain language—to turn your dream of owning a home into a clear path forward.

Published on 09/17/2025

Self-Employed? You Deserve a Smarter Mortgage.

Being your own boss has incredible perks—flexibility, control, and the chance to build something big. But when it comes to getting a mortgage? Traditional lenders don’t always see your value. At The Burks Lending Group empowered by NEXA Mortgage, we believe entrepreneurs, 1099 earners, and business owners should have access to flexible, powerful home financing. That’s why our Bank Statement Loan Program is designed just for YOU.

Published on 09/16/2025

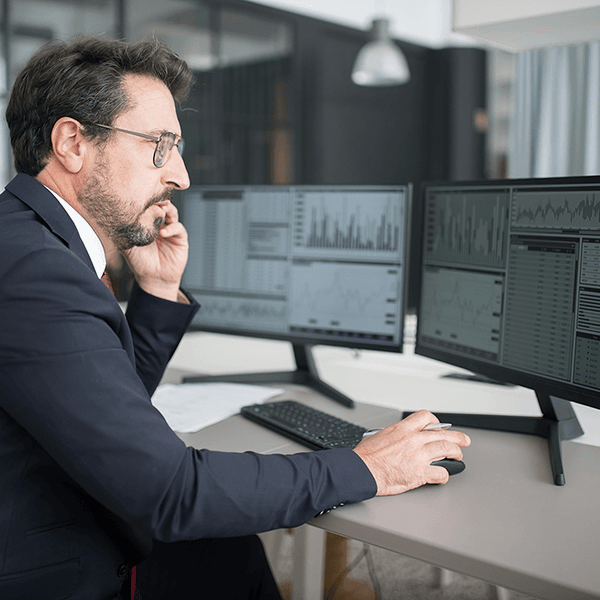

Mortgage Rates Near 11 Month Lows—What’s Next With the Fed?

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Why Mortgage Rates Move: What Every Homebuyer Should Know

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

Mortgage Rates Holding Steady… For Now

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025

Lower Rates? Don’t Relax Just Yet

Mortgage rates stayed mostly flat this week, holding near 10-month lows. Here’s what happened from August 18–20 and why upcoming economic data could shake things up.

Published on 08/20/2025

Is It Time to Refinance? How to Use Your Home Equity to Your Advantage

Are you carrying high-interest debt or looking to lower your monthly mortgage payments? A refinance loan could be the financial reset you need! Whether you’re looking to cash out equity, lower your rate, or reduce your term, refinancing can be a game-changer for your financial future.

Published on 08/14/2025

Mortgage Rates at 10-Month Lows! Big Opportunity!

Mortgage rates are holding near 10-month lows after early August’s jobs report and mixed inflation data. Here’s what homebuyers and homeowners need to know.

Published on 08/14/2025

Your Dream Home Awaits: 1% Down is All It Takes!

Unlock the doors to your future! With just 1% down, you can turn your homeownership dreams into reality. Let us guide you through this exciting journey.

Published on 08/05/2025